Do you search for 'option assignment meaning'? Here you can find questions and answers on this topic.

Stylish trading, assignment occurs when an alternative contract is exercised. The owner of the contract exercises the contract and assigns the choice writer to Associate in Nursing obligation to sound the requirements of the contract. Designation is a transfer of training of rights operating room property from cardinal party to some other.

Table of contents

- Option assignment meaning in 2021

- Options assignment process

- Option assignment robinhood

- Assignment of shares meaning

- Options early assignment

- How to avoid option assignment

- Put option assignment

- Option assignment vs exercise

Option assignment meaning in 2021

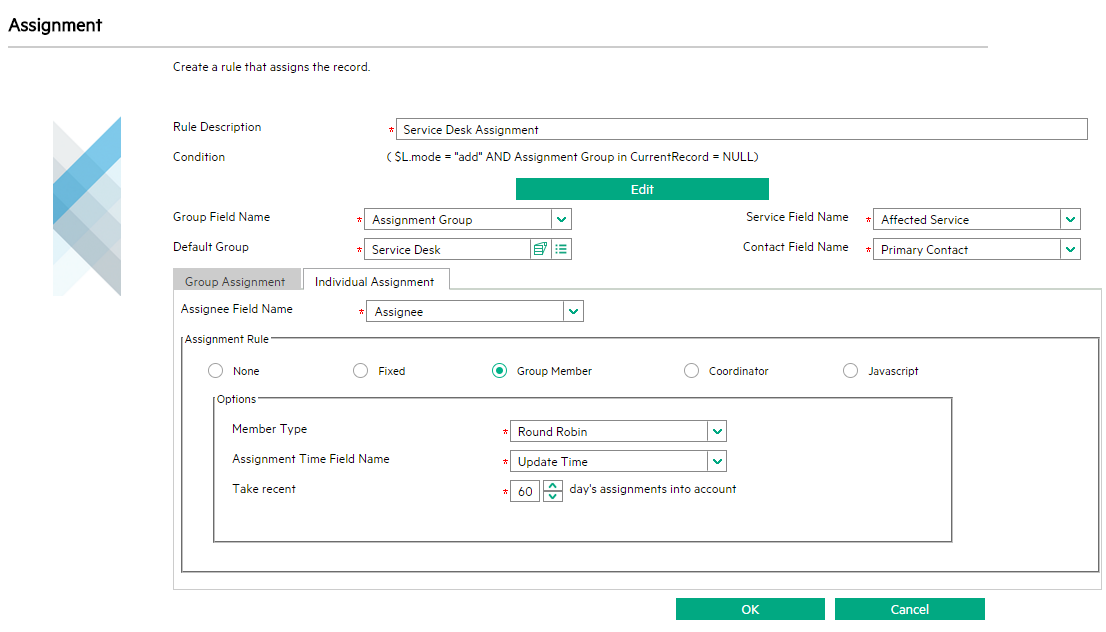

This image representes option assignment meaning.

This image representes option assignment meaning.

Options assignment process

This picture illustrates Options assignment process.

This picture illustrates Options assignment process.

Option assignment robinhood

This image shows Option assignment robinhood.

This image shows Option assignment robinhood.

Assignment of shares meaning

This image illustrates Assignment of shares meaning.

This image illustrates Assignment of shares meaning.

Options early assignment

This image demonstrates Options early assignment.

This image demonstrates Options early assignment.

How to avoid option assignment

This picture representes How to avoid option assignment.

This picture representes How to avoid option assignment.

Put option assignment

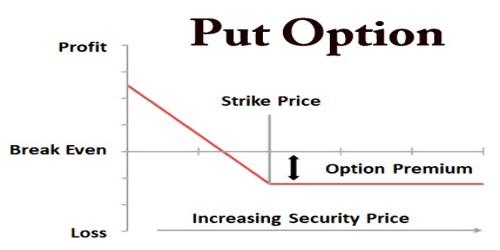

This image shows Put option assignment.

This image shows Put option assignment.

Option assignment vs exercise

This image demonstrates Option assignment vs exercise.

This image demonstrates Option assignment vs exercise.

How does option exercise and assignment work in stock market?

Option exercise or assignment can be partial: one can exercise less than all the options held. Conversely, you may be assigned on less than all your short calls or puts. However, one cannot exercise or be assigned on part of a single option contract. If you buy a call (put), you are not required to buy (sell)...

Which is an example of an option assignment?

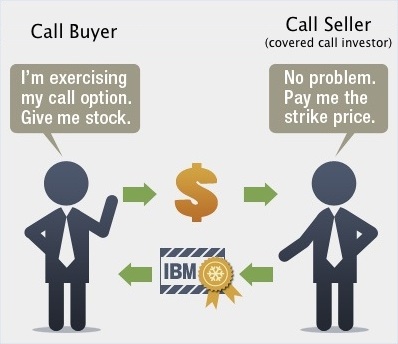

Examples of an Assignment. For an options assignment, the writer (seller) of the option will have the obligation to sell (if a call option) or buy (if a put option) the designated number of shares of stock at the agreed upon price (strike price).

What happens when an option writer is assigned?

The options writer is said to be assigned the obligation to deliver the terms of the options contract. If a call option is assigned, the options writer will have to sell the obligated quantity of the underlying security at the strike price.

What's the difference between assignment and exercise options?

Unlike exercising the option, assignment means they must sell if it is a call and they must buy it if it is a put. In the case of assignments, you would receive an assignment notice when your short options are assigned.

Last Update: Oct 2021